Some of the links on this page are affiliate links. When you make a purchase through an affiliate link, I earn a commission at no cost to you. See my entire disclosure policy for all the boring details.

We used EveryDollar for 9 months, then switched to YNAB. I have updated this post to reflect my current thinking abut EveryDollar after using it for 9 months. While it has some good features, my husband and I both like YNAB much better. (Detailed review of YNAB here.) In the meantime, here’s an completely honest EveryDollar review.

In it, I address how EveryDollar stacks up against the 6 main features I want in a budgeting app:

1. CUSTOMIZABLE

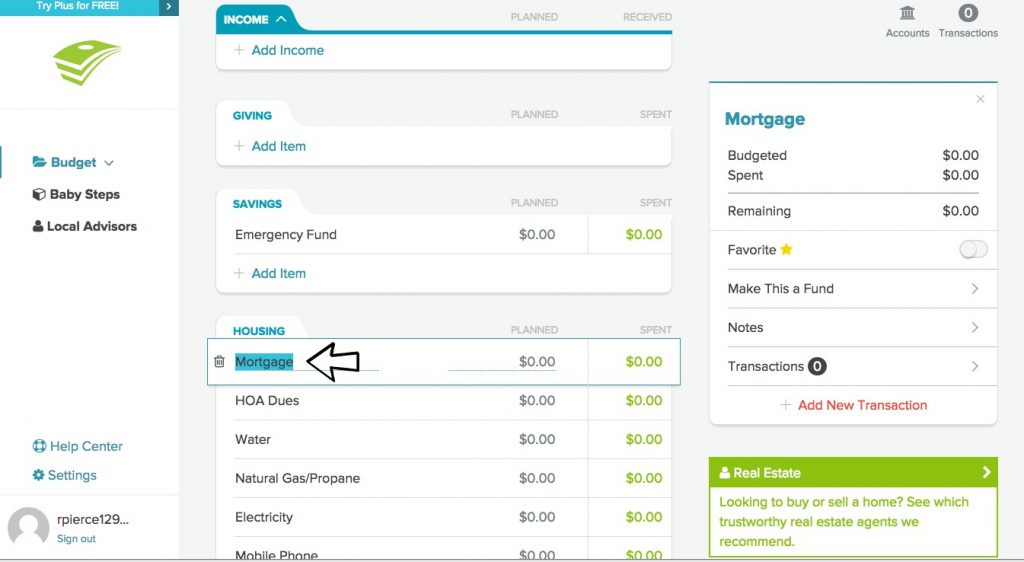

The customizability of EveryDollar gets and 8/10. You have complete control over the number and names of categories, just as you would in a spreadsheet. You have control over how you classify them as well. You can see in the screenshot below I clicked ‘mortgage’ and can change it to ‘rent.’

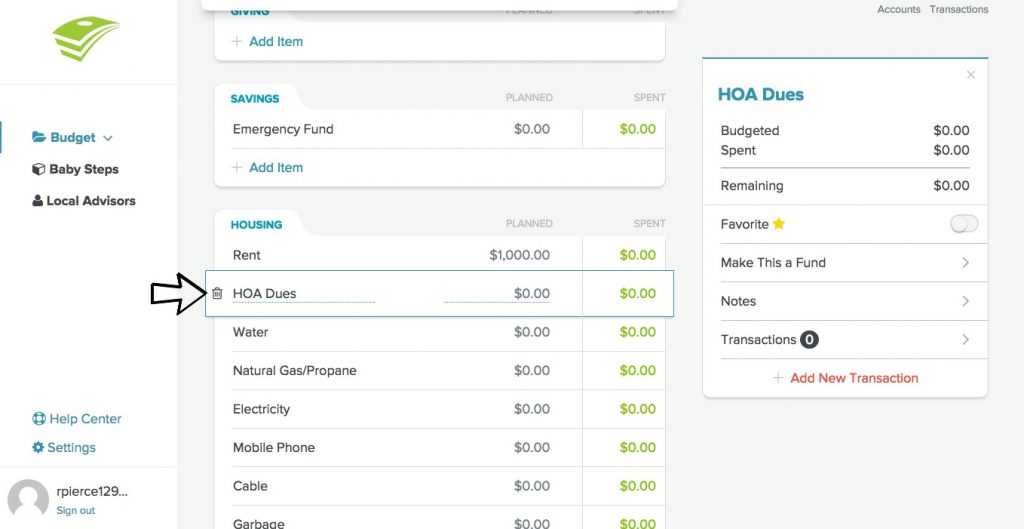

Or, since I don’t pay HOA dues, I can click the trash can and get rid of that line.

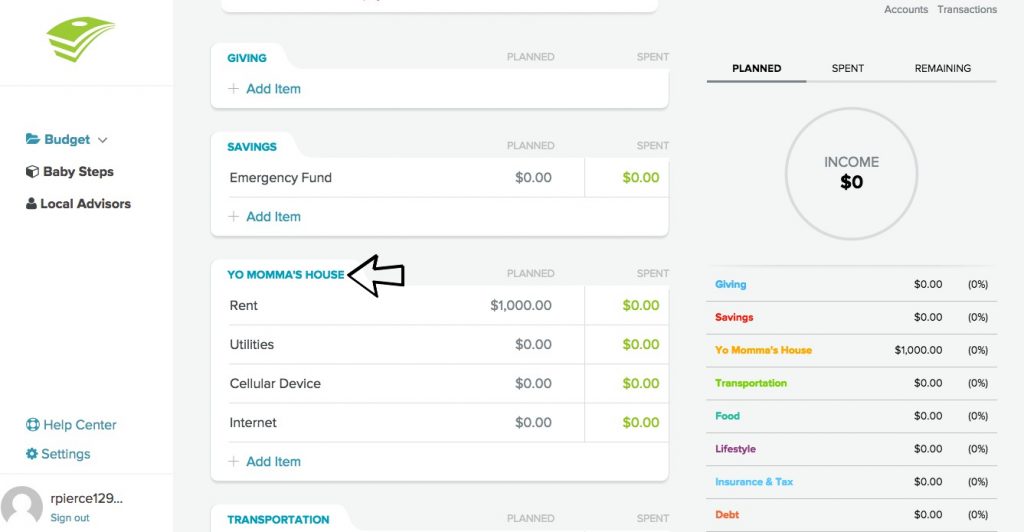

Or let’s say I prefer to change the budget group currently titled “HOUSING” to “YO MOMMA’S HOUSE.” Easy peasy. Just click “HOUSING” and type your preferred title.

Each month, you have the option to copy your current month’s budget for next month or start fresh.

Downside – You cannot move the category groups around. So, in the above picture, there is no way to click and drag the “savings” group to be under “yo momma’s house” group. You’d have to delete the groups and recreate them manually.

2. Rollover Sinking Funds Option

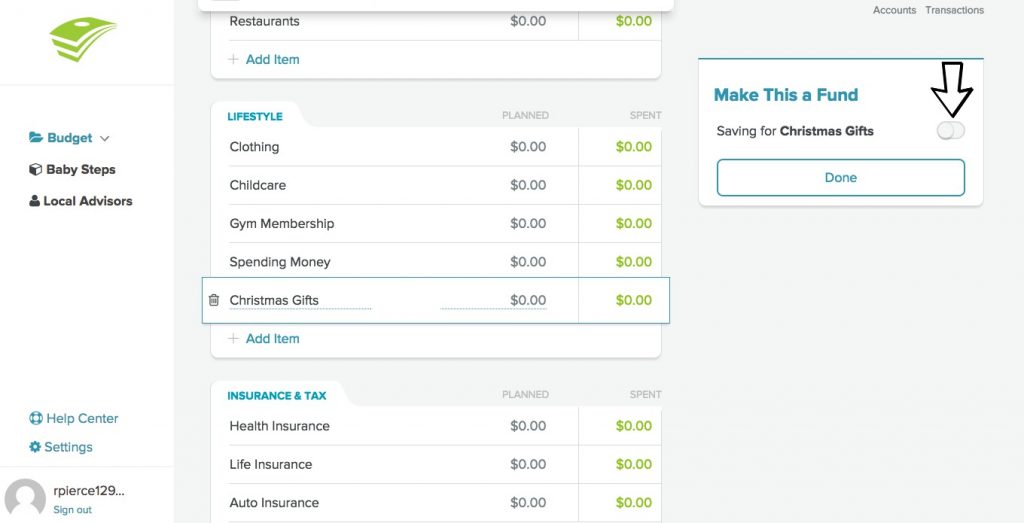

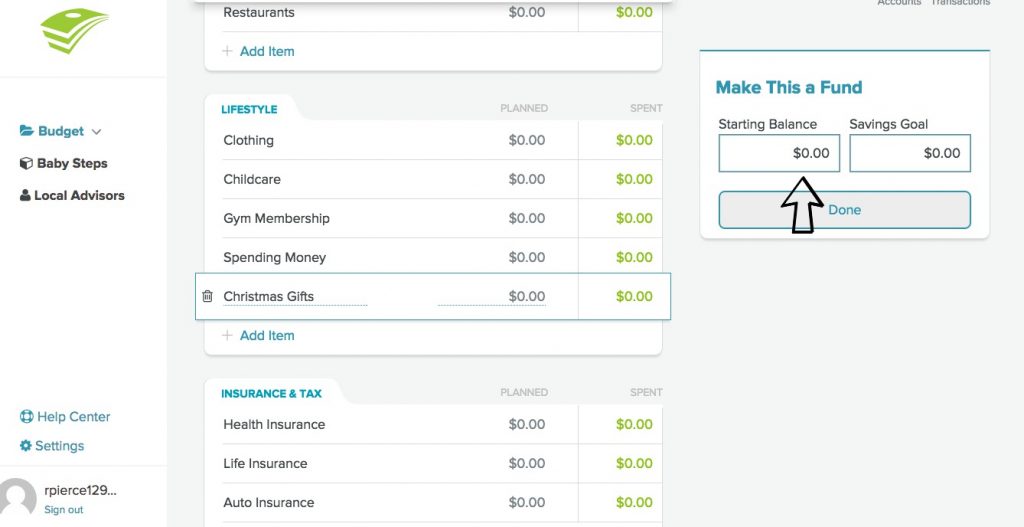

There is an option to ‘roll over’ budget categories from one month to the next or not. Let’s take the example of Christmas gifts. You know Christmas is coming. If you were to start budgeting for Christmas in June, you’d have 7 months to save up (including July and December). Let’s say you know you’re going to spend $700 on Christmas gifts. That breaks down to $100/ month between now and then. So, you set up a “Christmas Gifts” category on your budget and make it a fund.

I don’t think EveryDollar’s setup of this is totally intuitive. We ended up making every single category a fund so that we wouldn’t lose track of money. If you’re using EveryDollar, I’d recommend making them all funds because there’s no other way to account for extra ‘remaining’ money if it doesn’t roll over to the next month. (YNAB has a way better way of dealing with this, in my opinion.)

This tells EveryDollar that you want this money to stack up each month. So, in June, you turn on your fund and start the balance at zero. If you already had set aside $500 for Christmas gifts, you’d start the balance at $500.

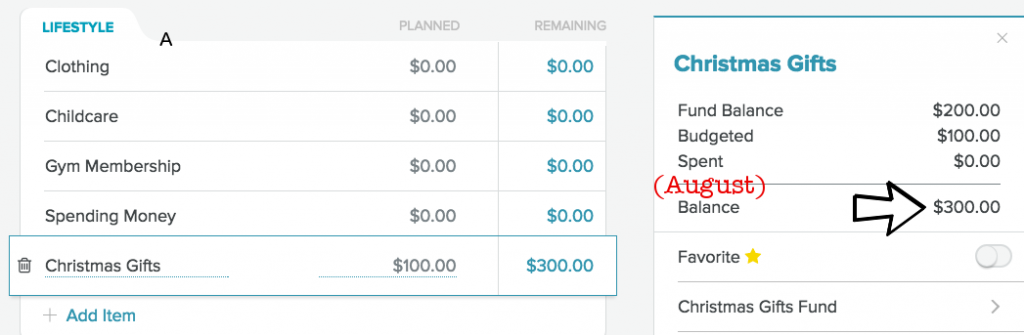

Then, in July, your budget sheet will note you are contributing another 100 dollars, but that the balance of this category, or this fund is at $200 (assuming you haven’t spent any). In August, if you hadn’t spent any, you’d have $300, etc etc etc.

We used to do this process manually on a spreadsheet, and I know a few other friends who track their “funds” within their checking accounts manually too. So, I like that EveryDollar incorporates an easy way to make some categories funds. But, like I said, the way YNAB handles sinking funds makes more sense to me.

Related: What the Heck is a Sinking Fund and Why Will It Revolutionize Your Budget?

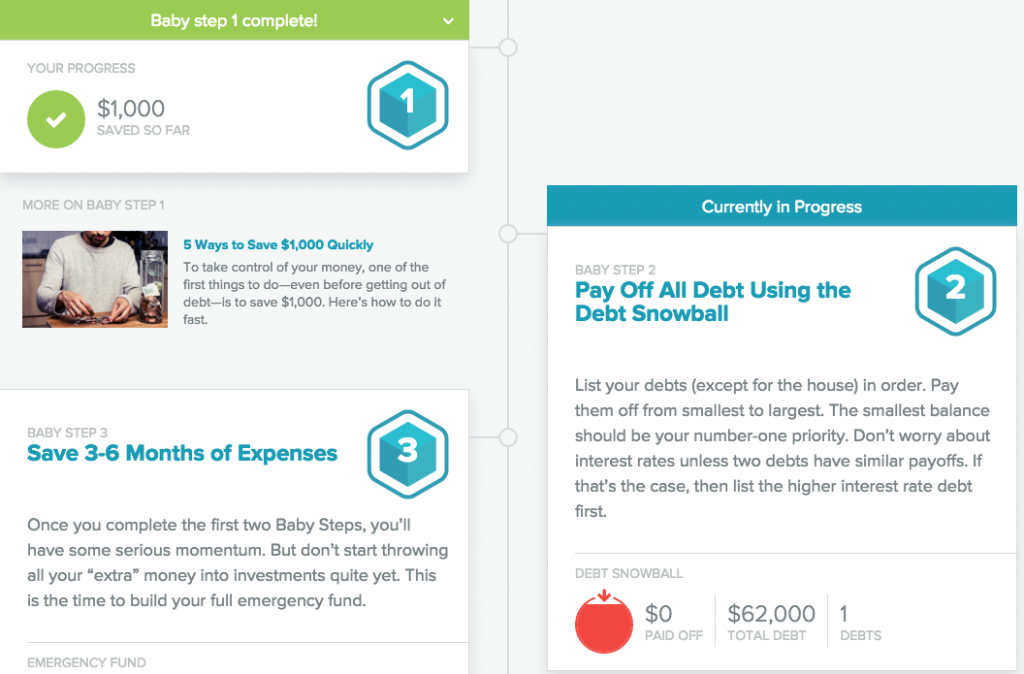

3. Connects with Baby Steps

If you follow along with the Dave Ramsey Baby Steps, you can make goals in EveryDollar that align with the steps. I like this in theory, but we couldn’t really figure out how to get it to line up and update. I’m sure that’s mostly a user error…. We have our own spreadsheet we’d been tracking debt progress in, so, when it wasn’t totally intuitive, we didn’t try very hard to figure it out.

4. Category Balances & Budget Adjustments

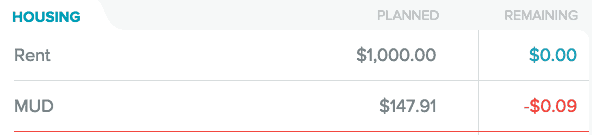

You have to click the number under spent/ remaining to see what you’ve either spent or have left.

When you’re on the “remaining” view, blue numbers are where you stayed within budget and red numbers mean you went over budget.

When you’re on the “spent” view, you just have to look closely and see that you went over, or click over to the “remaining” view.

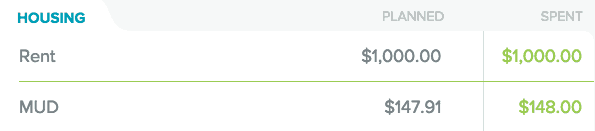

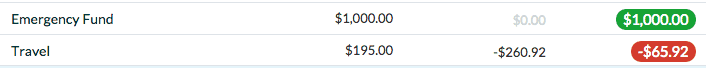

Honestly, the view part was super annoying to me! Again, easier in YNAB, which looks like this:

The left number is what you’ve budgeted; the middle number is what you’ve spent; the colored number is what’s remaining (green) or over budget (red).

With EveryDollar, if you go over-budget, and it’s not set as a fund, you have to manually notice it, and adjust the budget accordingly. Or, if you’re under-budget and you want to use the extra for savings, you have to manually change the original budget numbers for those categories.

YNAB has an automated way of taking care of this.

You can click the red/ green numbers and move the money to other categories. Otherwise, they automatically take overspending out of next month’s budget. (All the green numbers automatically rollover within the category.)

5. Tracking Your Spending

I know some people want a budgeting tool to automatically categorize their spending purchases. In that case, EveryDollar isn’t for you.

This is actually a “pro” to us! In all our budgeting experience, we’ve found that tools that automatically categorize all your spending for you don’t really work that well. They generally end up being too “hands off” for the budgeter. It’s hard to make progress in sticking to a budget if you don’t have to categorize your own spending.

Plus, the automatic tracking apps are typically glitchy & you have to spend a good chunk of time up front teaching those tools how to categorize your money. What if “Walmart” is usually connected to your groceries budget, but then one time you get a birthday gift there and then forget to categorize it accordingly? It throws off both your grocery and gift budgets. Or, if you go to Walmart and buy groceries, a gift, and diapers, you have to manually split the transaction anyway. I’m sure you could get used to that but it seems like a hassle.

Plus, there’s a bigger reason we like manually categorizing transactions anyway.

[Just a one minute side track from this “product review” style post to make a case for not using an automatic-categorizing budgeting software.]

Getting control of your money is emotional.

Just recently, someone I really respect and who is a good money-manager described the following to me: they use a credit card for most of their spending (to rack up the points), and then pay it in full every single month. They are debt free besides their home and don’t use credit to buy things they can’t afford. They merely use a credit card instead of a debit card in order to earn the rewards.This person said to me that their family recently decided to open two more checking accounts at their bank, one for the husband and one for the wife’s personal spending/ allowance/ blow money categories. We take out cash each month for those categories, but this family strongly preferred to not carry around cash, and had some other preferences in terms of carrying a card.

BUT, they recognized it was hard to track on a credit card even though they were paying it off in full each month. So they move the allotted amount at the beginning of the month into their “spending money” checking accounts, and each has a debit card tied to his or her account. Then, when the money is gone from there, it’s gone.

No more spending money until next month. The person telling me this described how it feels a lot different and they are much more careful now with their spending than when they used the credit card. “Because when it’s on debit, the money is actually leaving the account and it makes me reconsider whether I really want that item or not.”

And these are people who do not carry credit card balances or have any debt besides a mortgage. People who have a good handle on their money. And they still notice that it feels different to use debit than credit.

Spending money is emotional. And I am extremely convinced that if you don’t feel that you are spending money, it is much much much harder to stick to a budget. So, it makes sense then, that I have a strong preference for manually categorizing all of our purchases. This is what we’ve done on a spreadsheet for a long time. EveryDollar makes this so much easier because of the option to automatically connect to your bank account.

[side track over – back to the product review stuff]

So How Does EveryDollar Handle Transactions?

EveryDollar has two options for entering transactions:

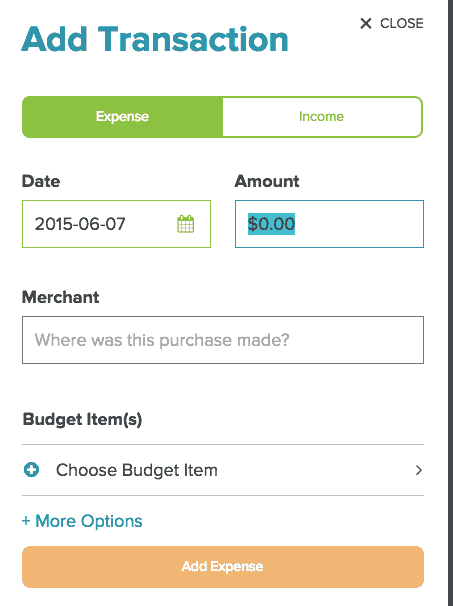

Manually enter it using this button and box (it took me 2 minutes to do 5 transactions).

This box will pop up and you enter in the information about your purchase.

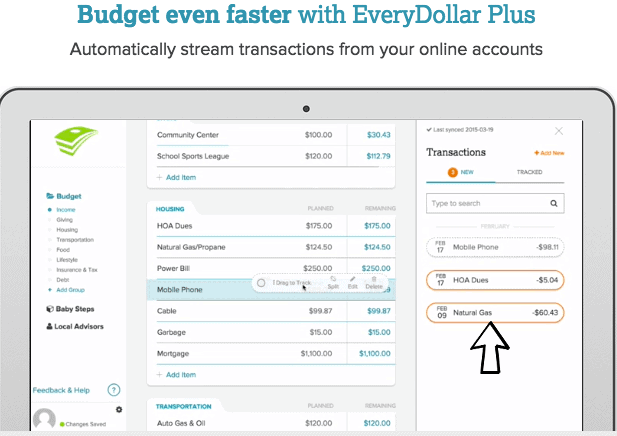

The second option is pay $99 for EveryDollar Plus, which connects to your bank account so your transactions show up on the side, and then you just click and drag them to the correct category.

After a month of using EveryDollar, we thought we’d stick to EveryDollar as our main budgeting tool, so we decided to pay for this for two reasons. Convenience. Obviously it’s easier to click and drag than to type in the transactions (even though typing them in doesn’t take much time). Were it only a matter of convenience, we probably would just do it ourselves in the spirit of not-spending-extra-money-to-get-out-of-debt.

But a few times, we’ve missed purchases. And when you’re tracking every dollar you spend and you miss one, it gets pretty complicated. We’ve dumped extra money towards loans only to have a debit card transaction clear a few days later that we forgot about. We just decided it was worth it to not miss any transactions to pay the $99 for a year. EveryDollar is free, but if you want to connect to your accounts, it’s $99 for one year up front, which is what the banks charge them to connect. If you’re going to pay the $99, don’t forget to budget it in 🙂

$99/ year seems high to me, especially since YNAB is $50/year and they connect to your budget too.

6. Generally Glitchy

We found that while we really wanted to like and stick with EveryDollar (since we had paid $99 for it and done 9 months worth of budgeting with it), it was just too glitchy. 🙁

Conclusion of EveryDollar Review

- EveryDollar is a fine basic budgeting tool, but not great.

- The free version functions basically like an automated version of a pen and paper. There’s a lot of manual messing with it required.

- It’s better than nothing!!

- Ultimately, I think YNAB is way better, and have reviewed it in detail here.

Anything I missed? Have you tried this new budgeting tool? If not, what do you use to budget? If you have any questions or comments, feel free to comment below.

Happy budgeting!

Phil, that’s a GREAT idea about switching everything over to funds! If I recall correctly, that’s what my husband and I did as well when using Everydollar. I think what you said about your wife liking it & you guys fighting less is the most important!! Finding something that works for your family & makes it easier for you to talk about & manage money is the BEST! Thanks for sharing your idea.

We’ve been using everydollar for three years (the free version only). After about a year or so, we switched everything over to funds. That made it easier to maintain. I have no problems entering the transactions manually, but I’m nerdy enough to have done that in a spreadsheet before we started everydollar. The big plus for us was that my wife likes it and she can easily see it. So we have far fewer fights about money and we have more discussions about what we’ll do with money in future months. I read a book on YNAB and the approach sounds cool, but I just don’t want to pay for something that might be a little better to replace something that’s working well and is free.

Thank you!! I’ve thought about updating it because it’s been a long time since we tried it 🙂 Thanks for the tips – I’ll check that out!

The first two items, customizing Categories (Groups) and Funds, has been updated in EveryDollar.

It’s worth revisiting and updating your review. You may find it to be a bit better.

Thanks for the review, though! Very interesting!

I agree!! We ended up switching from Everydollar to YNAB too 🙂 Glad this helped. The multiple accounts feature is so convenient. and the YNAB app is pretty good now too!

This is an old post, but I stumbled on it while trying to figure out how to use Every Dollar. I have been using UNAB for 2 months and I LOVE IT. But my 2 month trial is ending and I was trying to see if I could use Every Dollar instead and so far, the answer is No. YNAB is easy to use, easy to understand, and I really like that it lets me have money in different accounts (even manually) because I have cash, I have my own account, my boyfriend has an account, and we have a shared account so I like to be organized and see what is being spent and from what account. From what I can see, the free version of every dollar doesn’t allow this. Thanks for posting!

Yes, we had some tech glitches too. It’s too bad! No glitches with YNAB… did you read my review of that?

We have used Everydollar for about a year., I love it and its features BUT I always have a problem with the transactions appearing 2 and 3 times. I spend a lot of time deleting transaction and having go back through each category to see if any are in there more than once. I have contacted them and was told it is the way my bank clears transactions. I don’t plan on switching banks so I am looking for new software to see if that fixes it. This makes me sad thought because other than that it is great.

Did you see that I edited this post? 🙂

Chuck,

Again so helpful. Thank you for spelling all this out. That is a good system you have – to have your software/internet linked and auto popping up. You do make YNAB sound easy. I definitely want to check it out again. I agree with you about living off last month’s income – getting ahead is huge in budgeting and makes it so much easier (once you’ve disciplined yourself not to dip into that cushion by spending based off CATEGORY BALANCES not bank account balances.) You mentioned that as well, and I agree with you on that! It’s a key to being a good budgeter 🙂 We don’t write checks (all checks we pay – landlord, church, etc..) are automatically cut out of our bank account so I haven’t dealt with that on Every Dollar. But I’ve thought about it based on some things I read and agree that it’s a downfall. When you write a check, that money needs to be out immediately, not when it clears… that’s when people get into trouble.

Interesting to hear your method of credit card use. I agree with you in that when you use category balances to control spending, it doesn’t matter what you pay with. I also agree with dave that all the stats show 90-something percent of people spend more with plastic than cash. I think you can both be right on that. It is possible to control your spending and use credit cards as you are doing, but most people can’t. I also understand why he tells people not to use them since his whole ‘thing’ is getting out of debt as a first priority. 🙂

Definitely going to check out YNAB again, but maybe I’d ask you to write a review/ tutorial on it for my site as a guest author since you’re so well-versed in it! 🙂 something to consider!

Hi Renee,

To clarify about YNAB – it doesn’t connect to the bank. However, it does support Quicken QFX files, which most banks and credit cards allow you to download. I have YNAB set up on my computer to be associated QFX files, and Chrome has been told to automatically open a QFX file after downloading it. So I log into my bank, click a link, and YNAB pops up with a list of transactions to import.

I can reconcile 8 accounts on 3 websites (including our AMEX card, which EveryDollar doesn’t support) in less than 5 minutes with this process. And I can’t reconcile anything with Everydollar Plus, because if I enter it by hand, I have to delete the downloaded transaction or I’ll double account for things.

Have you dealt with checks yet in EveryDollar Plus? Just… Plain… Dumb…

One of the differences I have with DR is that once every dollar’s been given a job, when I’m spending money from a category I really don’t care what I pay with. (If there are dollars in the bank, it doesn’t matter if I pay the vendor directly or I charge it to my Costco Amex and pay them.)

We have 3 credit cards which are set to auto-pay the full balance every month. And I don’t have to think about it because we use our category balances to control our spending – not the checking account balance.

EveryDollar also has you budget money you don’t have, which to me means that your category spending is just a broad idea about how not to be overspent at the end of the month. YNAB’s approach of only budgeting dollars you have means that if the category has the money, you can spend it. If it doesn’t you can’t because you might overdraft your checking account. EveryDollar leaves you still worrying about scheduling payments around paychecks (can’t pay bill X until the 24th when that paycheck arrives, etc.)

Once you’re “buffered” as YNAB calls it, and “Living off Last Month’s Income”, then budgeting really gets fun. No more worrying about dates to pay things. The buffer becomes an extra month of Emergency Fund, but one that contributes to your piece of mind and relaxation instead of just sitting in an account.

Thanks for the insight! I need to check out YNAB again 🙂 When we used it, they didn’t have the bank connecting feature. We love that feature of EveryDollar. We do live a paycheck ahead and plan to live much further ahead than that when we’re not working our way out of debt. (Something about cutting it close keeps us motivated!) But, I agree, I like the philosophy of living one month ahead. Thanks for popping over and for giving some feedback! I’ll have to take a look at YNAB and see what’s new. We owned it back in the day… I wonder if there’s a way to access the newest features?

I provided a review of EveryDollar on reddit: My EveryDollar Review

I’m also a Dave Ramsey fan, but YNAB is a much better deal than EveryDollar Plus ($60 one time vs $99/yr), and gives you just as much control. To be honest, Everydollar should be called “MostDollars” when compared to YNAB’s approach which really does expect that you will give every dollar a job. (That’s why it starts with entering your account balances, and expecting you to assign those dollars a job, unlike EveryDollar.)

As you found, without the ability to reconcile your entered transactions against what’s hit the bank the oversights or errors will give you grief in budgeting.

So if you want a “rough budget” EveryDollar is fine.

If you actually want an budget where you know that you can make a mortgage prepayment of every spare penny, then YNAB is the tool.

And, if you want the true financial peace of living on last month’s income (so you get out of the business of planning on which day you can pay what bill) then you really want YNAB.

I agree – I like different features too but we now use everydollar exclusively. We have 1 shared personal checking account & a couple short term savings accounts at capital one 360. No credit cards. No other accounts. Except some Roth IRAs with Edward Jones. So we don’t really feel the need to have everything on Mint… we have found if we do one thing at a time we tend to be more diligent and more regular at keeping up with things.

Thanks for your response, Renee, and for introducing me to some really useful budgeting programs and ideas. Do you use EveryDollar Plus exclusively or do you still use Mint.com for their graphs and totals of bank account amounts? I like different features about each program I’ve tried.

Lauren, I think any budgeting tool that you can use easily will help you save well over $100/ year. It’s actually free to set up and use. It only costs $99 if you want to connect it to your bank account and then “click and drag” to categorize your expenses. My suggestion would be to use it free for a couple months and then decide if you want to pay to make it a little easier or just keep entering transactions manually. You could certainly do it manually and I think it’s still pretty easy! 🙂

Hi Renee! I really like the sound of EveryDollar Plus, but I’m wary of spending money to save money. Do you feel like the program helps you save more than $99 a year? Does it make up for its cost (and then some)?

Andi,

Thanks for your comment and for reading! I’m glad the review was helpful. Sounds like we have some budgeting tendencies in common!! We’ve gone through that same process of not quite being able to find something that works with digital transactions and yet holds you accountable (and is easy for 2 people to do together). The more we use EveryDollar, the more we love it. Hope you like it!! Let me know if you have any questions as you get started. Also – the anxiety and entitlement posts. Phew. Those were heavy ones. There are lighter-spirited ones too. But hey, why not just get to the good stuff?! Haha 🙂 Glad you stopped by.

Hi Renee!

Thank you very much for your review. From one Dave Ramsey nerd to another, I appreciate it greatly. I too have tried about everything (which can get expensive and very time-costly). And keep resigning myself to spreadsheets, but I constantly fall behind on them or my husband is spending without knowing if we have the money in the proverbial envelope. We try going to all cash but it’s just not how we work. And the digital transactions make the envelope system almost impossible, especially between the two of us.

I was on the hunt again today for a software solution and am thrilled to have found EveryDollar but wanted to hear some reviews before I made the plunge. I’m excited that it will truly allow us to be proactive (just like envelopes), rather than REACTIVE…which is how all other softwares ultimately make me feel.

And lastly, while here I poked over to your post about anxiety and your one about entitlement. I love the spirit of your posts and will look forward to following more posts!