Some of the links on this page are affiliate links. When you make a purchase through an affiliate link, I earn a commission at no cost to you. See my entire disclosure policy for all the boring details.

YNAB is by far, our favorite online budgeting tool for tracking spending and money management. YNAB costs $99/ year, and the most frequently asked question I get about it is, “Why pay when there are free budgeting tools available like Mint? Is YNAB worth the money?”

This YNAB review is meant to answer that question. I’ll first list our 10 favorite features, then the 2 cons (which are barely cons) of YNAB.

YNAB stands for You Need a Budget. In 2016, YNAB moved from being a downloadable software program to being an online (web-based) budgeting program. We have tried several budgeting systems and tools over the years: Mint, Everydollar (my complete Everydollar review here), spreadsheets, random apps, and now YNAB. As of 2023, we’ve been using YNAB for 8 years and have recommended it to countless friends and family members.

Here’s how YNAB works and how to use YNAB for your personal budget.

*Note: In the past year, we had a MAJOR ah ha about how YNAB is supposed to work. I wrote about it on this short post and highly recommend reading it and then coming back here!*

1. Connects to Your Accounts (Optional)

YNAB offers you the option of securely connecting to any type of account or you can enter your spending manually. It’s easiest with a debit card, but my husband and I both use credit cards on the same credit card account. Both our bank account (debit/ checks/ cash) and our credit card accounts are tied to our budget in YNAB.

Every 5-10 days, I login online, click “import,” and categorize all the transactions into various budget categories. (If you want to know why you should track your spending, read this.)

If you prefer to enter your spending manually, I recommend getting professional help because no one should willingly submit themselves to such pain when an automated option is readily & inexpensively available. And this coming from a former die-hard-manual-transaction-enterer.

JK. But seriously.

2. Easy to track spending

YNAB has the perfect combo of automated and manual categorizing. Like I said, you can opt to NOT connect to your accounts and enter all spending manually.

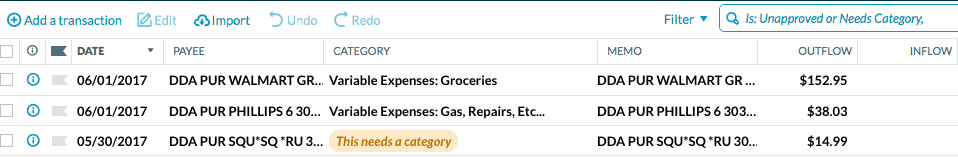

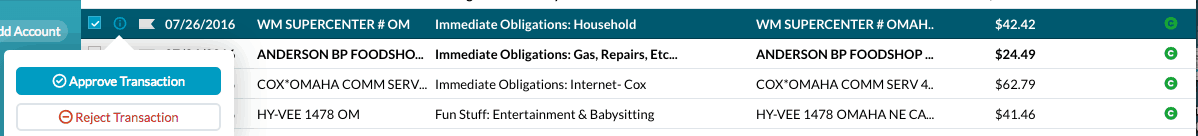

If you do connect your accounts, YNAB will learn your spending habits. Bold transactions are new. This means, I haven’t categorized them yet. But, as you can see in the picture below, YNAB guessed the categories for me. Then, all I have to do is click approve.

They don’t finalize anything without your approval. It forces you to check every transaction and make sure it’s being properly categorized.

This feature makes budgeting super fast for all the places that are the same category every time: bills, utilities, etc.

The ones I usually end up changing are Walmart and Target trips because we get things from different categories at those stores (groceries, diapers, household, gifts, etc…)

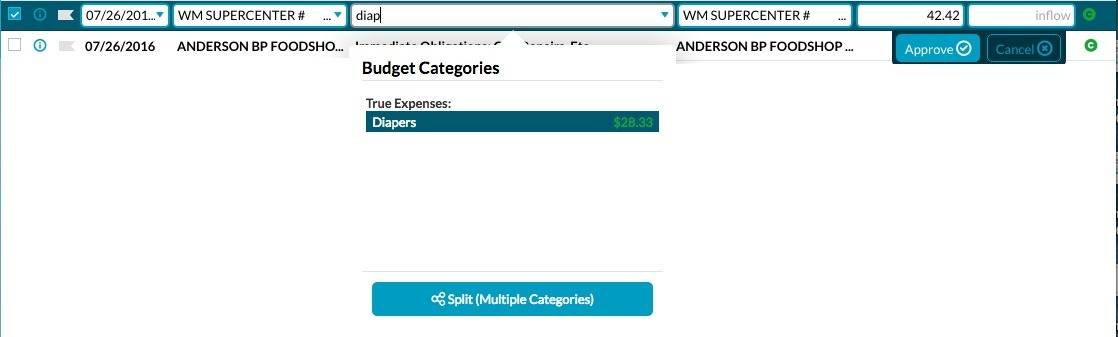

If YNAB guesses wrong or leaves the category blank, it’s easy to categorize. You just click the wrong category, and start typing the right category. It autofills for you and you hit enter.

Y’all, I used to manually enter every single dollar we spent into a spreadsheet.

I prefer this semi-automatic method of categorizing spending to a 100% automatic process like Mint.com because it forces me to know what’s going on with our spending, yet it’s way simpler (and more accurate) than entering everything in by hand.

Approving each transaction holds me accountable by reminding me of what we’ve been spending, and forces me to keep an eye on our accounts in case there’s any fishy activity. (We’ve had our checking account hacked in the past. Ugh!!)

3. You Can Split Transactions

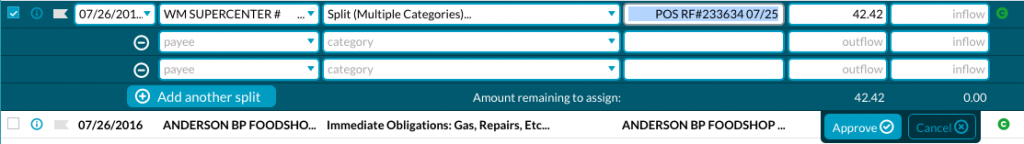

If you went to Walmart for diapers, toilet paper, bananas, and gardening supplies, you can easily split that transaction. Just hit “split” and fill in a few different categories and the amount you spent in each category.

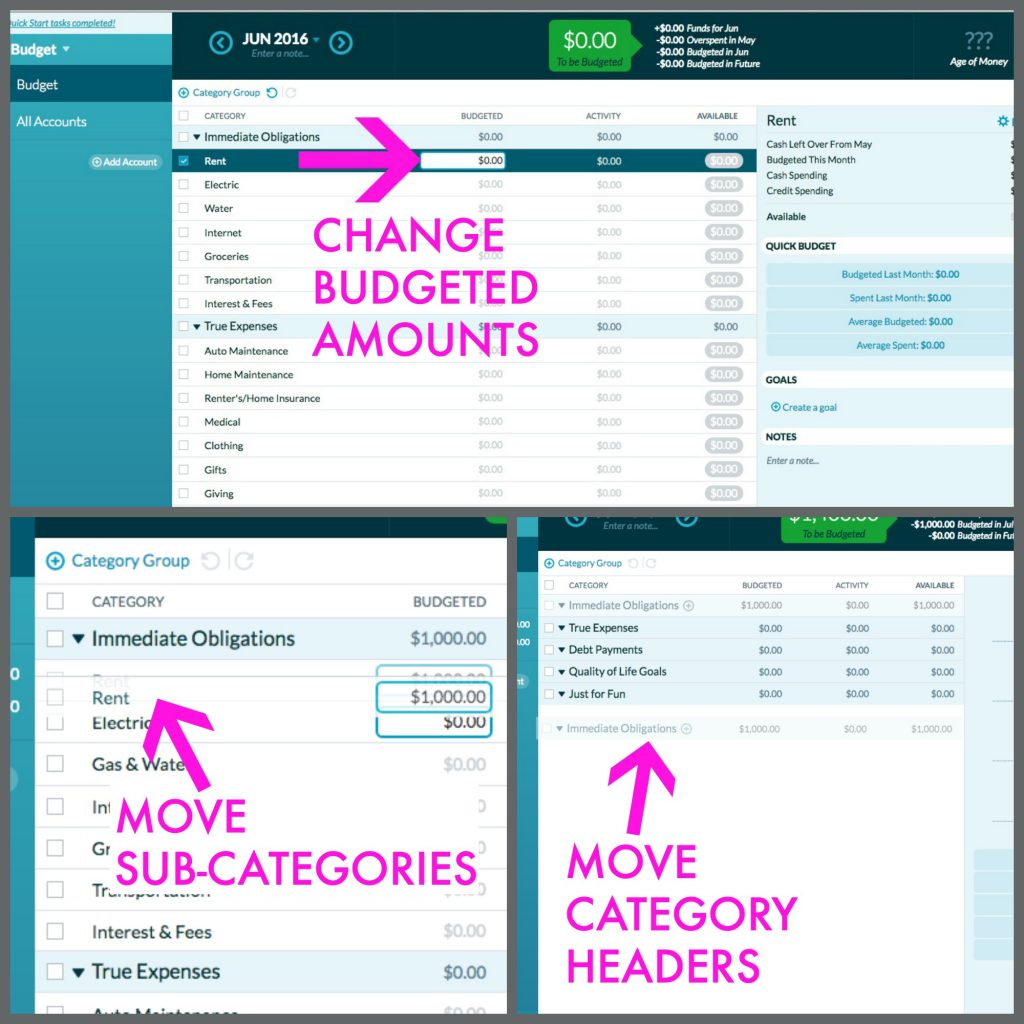

4. Completely Customizable

You can customize everything in YNAB… the budgeted amounts, the names and orders of all the categories. There are suggested categories and sub-categories when you start your first budget, but you could delete all of it if you want and start from scratch. You can make the budget work however you want it to.

5. Starts with What You Have

Whether you’re going to use the software manually or connect it to your accounts, you just start with whatever amount of money you have right now, and go from there.

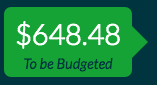

Say you have $648.48 in your bank account on the day you start your free trial with YNAB. This is what will appear on the top of your budgeting form.

If you enter $100 in groceries, the number will go down to $548.48 “to be budgeted”.

If you budget more money than you have, it’ll turn red.

I like that YNAB doesn’t overcomplicate starting a budget. You just connect your bank account and go.

After all, the best way to start budgeting is to… just start. Just write down how much money you have right now and in what ways you need to spend it until you have more money.

This is called living paycheck to paycheck. It’s not the ideal, but if it’s where you are now, then it’s where you are now. So, accept it and just start. You’ll figure out a lot along the way. (You can sign up for your free YNAB trial here.)

YNAB is built with the goal of helping you “age your money” and stop living paycheck to paycheck.

By age your money, they mean they want you to get an entire 30 days ahead of your money. So, by the end of October, you have enough to live on for the entire month of November. They explain their philosophy more here.

6. Sinking Funds Build Up: I YNAB-ed It!

In YNAB, your category surpluses roll over (unless you empty them – more about that in the next point). If you spend $1200 on Christmas gifts, you can put $100 into a Christmas budget category each month. It’ll automatically roll-over until December when you have $1200 in that category. This is called a “sinking fund.” (You can read more about how to use sinking funds here.)

YNAB makes sinking funds so easy! You could have a sinking fund for things as small as renewing your car registration. Does it cost $200 annually? Just add a category and budget $16.67/ month.

Then, don’t spend money from that category and watch it grow month after month. When you get the notice in the mail, cheerfully pay your $200 fee and say, “Bam! I YNAB-ed that car registration fee like a boss!!”

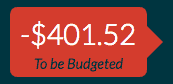

You can see an example of a couple different sinking funds we use below.

In YNAB, every single item is a fund automatically. You can’t change that like you can in, for example, Everydollar. In Everydollar, you turn funds on and off for each specific budget item. (You only have to do it one time, so it’s a tiny hassle but not a big deal).

In YNAB, if you DON’T want the extra money to roll over at the end of the month, you can move it, which I’ll explain next.

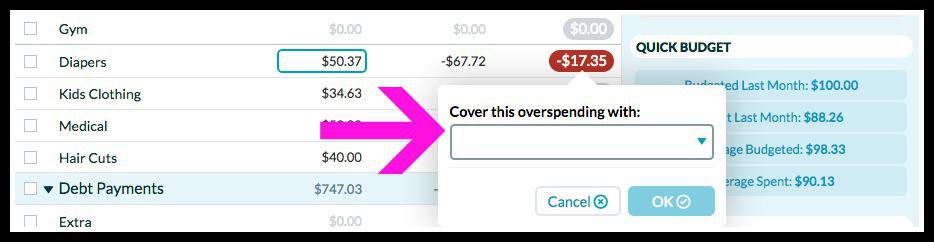

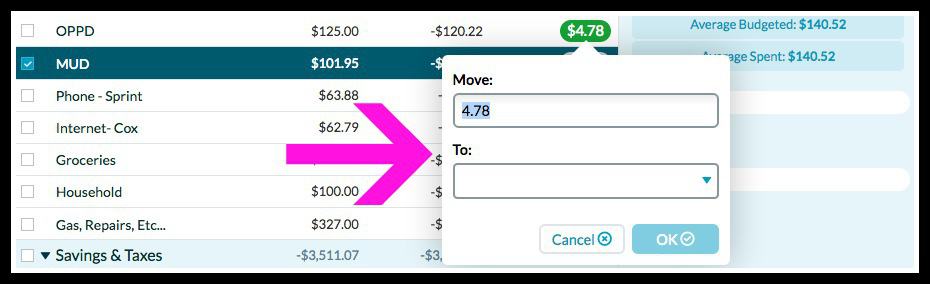

7. Covering Over Spending + Moving Surplus Money

This feature might be my favorite thing about YNAB. If you overspend in a category, you can cover it with another category that you have extra in. (Although, if you’re overspending in a category every month, you probably need to budget more moola into that category.)

On the flip side, if you have extra money in a category, you can move it somewhere else. At the end of every month, we go through all the green categories that ARE NOT sinking funds and move the extra money into our “extra debt payments” category. (picture below)

I seriously love this feature, which YNAB calls “roll with the punches.” It makes spending less than we budget feel like a fun game. (Ok, so our idea of fun may not be your idea of fun…)

Here is Ynab’s quick explanation of the “roll with the punches” concept.

- Give Every Dollar a Job

- Embrace Your True Expenses

- Roll with the Punches

- Age Your Money

If we spend less, we get to click the fun green button and move the money to the debt category. Then we make a random extra bonus payment towards our loans. If you don’t have debt, move the extra money into a fun savings category!

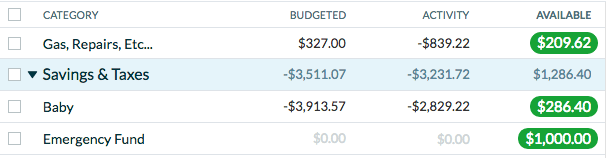

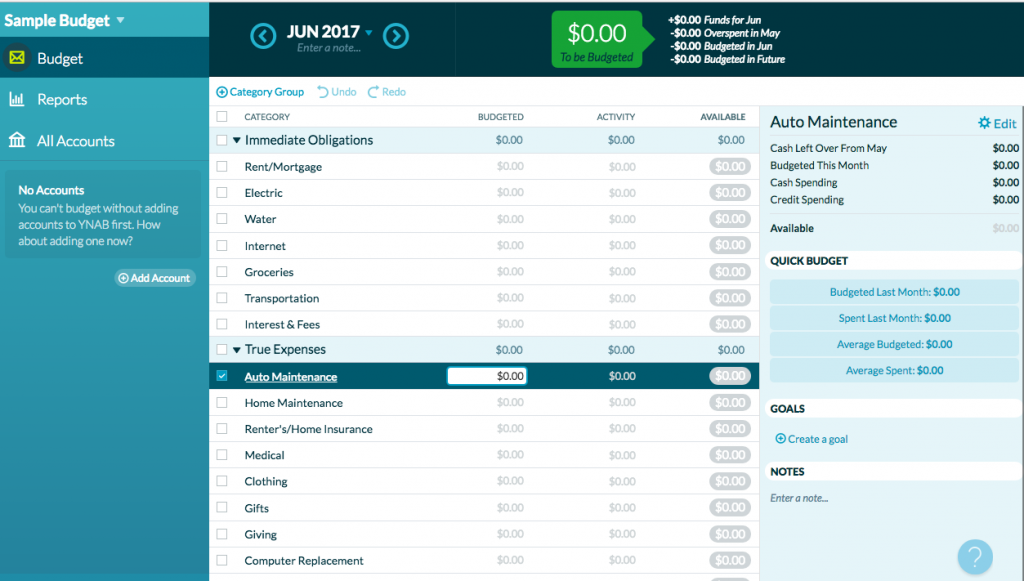

8. It tells you how much you spend on average in each category.

The “quick budget” box on the right of the image below helps you fill in your monthly budget really fast.

The “spent last month” category is helpful for the fixed categories that I don’t always remember the exact amounts on – electric, gas, life insurance, car insurance, etc. Those seem to all have really random numbers like $33.96. Instead of flipping back and forth between last month and this month, I just glance over to the side and see what we spent last month and plug that number in.

The “average spent” category is a helpful guide for variable expenses like gifts, clothes, and groceries. The longer you use YNAB, the more helpful the average is.

If you’re new to budgeting, that little “quick budget” is a helpful analysis of your spending! If you categorize diligently for a month or 2, you’ll easily be able to see how much you spend in each category, and make budget changes accordingly.

9. Amazing Customer Service

You can search their detailed help center for easy-to-understand explanations or quick video tutorials. If something doesn’t make sense, though, there’s always a little ? mark in the corner and you can easily send a message. They respond quickly and are very helpful.

When I didn’t understand how the credit cards worked, someone went back and forth with me over email, eventually making a screen shot video for me. I’m a slow learner! But, they were so helpful

10. YNAB Has an Updated App That Works Really Well (as of 2019)

This point actually used to be a con because they didn’t have a good app. Recently, YNAB launched an amazing app. It’s easy to use and you can do everything on it that you can do on the desktop version.

I still find the computer easier and faster, but you can use a mobile device to do everything. I sometimes do my categorizing on the go & I definitely check my budgets when I’m out and about now.

This is officially no longer a con!! Go YNAB!

CON #1 – The Credit Card Learning Curve

Maybe it’s just me, but it took me a while to figure out how to understand YNAB’s handling of credit cards.

I don’t know how YNAB compares to other budgeting programs with credit cards. For a really long time, we used debit exclusively. We finally caved and got a credit card, mainly for the security aspect. (Our debit card got hacked and it was a MASSIVE hassle to deal with the bank to get our money back.)

Plus, when your debit card gets hacked, it’s your actual money. Not credit.

Besides YNAB, I’ve only ever tried budgeting with credit cards in Mint and I hated it. I was so confused!!

Anyway, you can connect your credit card to your budget in YNAB. Heck, you could do all your spending on your credit card! You basically still budget the same way. You budget the money you have IN THE BANK into different categories.

When you spend it on a credit card, YNAB automatically moves the money from the category to the credit card. Then, when you pay your credit card from your bank account, you count that transaction as a “transfer” in YNAB (as opposed to regular income or outflow).

The upside is – YNAB allows you to budget your money with a credit card. And it’s actually pretty cool how it works. AND they encourage you to be debt free even if you spend on a credit card.

The downside is – there’s a slight learning curve and budgeting for credit card spending isn’t quite as easy as budgeting for cash/debit spending.

But you get used to it! Here are a couple articles and videos from YNAB to help understand the way they handle credit cards + budgeting.

TIP: We have found it is easiest to use YNAB with credit cards if we manually pay our credit card bill every week when we sit down to check in our budget, which we call a “money date.” If you let your credit card get paid on auto pay, it’s almost a full month behind in terms of your actual bank account & money.

In general, if you use a credit card for daily spending, I highly recommend paying it off frequently which essentially treats it more like a debit card, and your money isn’t “behind.”

What’s a Money Date, You Ask??

We know you’re jealous of how cool we are… But, we have money dates.

We used to sit down together almost every single week, categorize all the spending, check our budget, and make a student loan payment. It took about 30 minutes. If we missed a week, it would take a lot longer & we’d often end up going over budget. Haha it was definitely a learning curve.

We’re no longer in debt (and we have many years of communicating about money under our belt), so now we check in with it once a month together. I update the budget on a weekly basis and we kinda just look over things monthly.

CON #2 – Net Worth Views Aren’t As Informative

Like I mentioned, we have tried other budgeting platforms in the past, namely Everydollar, Mint and Personal Capital. We still use Personal Capital for tracking net worth and the big financial picture.

YNAB includes net worth tracking, but it’s just not as comprehensive as Personal Capital. Personal Capital was actually built to be a net worth tracker, and YNAB was built to be a day-to-day spending tracker.

So we use a combination of YNAB and Personal Capital to manage our money. (You can get $20 and try Personal Capital for free here! We love Personal Capital for providing the big picture financial overview.

So, Is YNAB Worth the Money?

Clearly, I think so. Honestly, I could go on and on about YNAB. (Oh wait, I already have…)

They have tutorials galore and great chat-help. Plus, the people at YNAB are really smart about money and offer lots of great articles and videos to help you get on track financially. (Check their learning page out here!)

After your free 34 day trial (no credit card required), you’ll pay $83.99 for the year, which breaks down to $6.99 a month. I could almost guarantee you’ll save 10 times that per month using YNAB to track your spending and budgeting.

You can basically make it do anything you want to! After exploring several of the main budgeting tools available, I’d highly highly highly recommend YNAB to anyone. (3 “highly’s”, people.)

Did I cover everything? Ask any questions you have or pitch in with your thoughts about YNAB in the comments below.

Happy Budgeting!

Hmmm! I use a spreadsheet for my business. I’d imagine YNAB would work for business use, but I’m not totally sure as I haven’t tried it myself. Sorry I can’t be of more help!

I’m self-employed. Will YNAB work for me to track business expense categories? I’ve been using EveryDollar for budgeting (free version), but end up having to double-enter all my transactions in an old version of Quicken so I can print business category reports for tax time.

Hey Jim! Thanks for reading and for your comment. We used personal capital for a while and very recently switched to wealth front. We use them for holding our cash savings too 🙂

Hi Renee!

Really enjoyed your review. I have been using YNAB for over a year now and absolutely love it as well. However, like you mentioned, I am struggling with the lack of reporting and NetWorth/Investment tracking. Curious if you link all your spending, savings and credit accounts and download all your transactions both in YNAB and Personal Capital.

oo thanks for letting me know!! I’ll try to fix it. My site went down and I wasn’t paying attention because I had been taking a blogging break on here because I’m “not so secretly” working on a money managing site. Anyway, I’ll see if I can fix that pin! Thanks Jessica 🙂

Hey great blog…I’m going to try YNAB, currently using the free Every Dollar but I keep forgetting to add my transactions…such a pain and I didn’t really care for the paid version either. Anyway just wanted to tell your pin image but the URL was empty so I had to do it manually, which was frustrating bc my internet is going slow but I wanted to save your post. 🙂

oo thanks for the info, Rebecca! I definitely will update!

You might want to update the cost of YNAB. It went up to $83.99/year for new users a few months ago. Older users are grandfathered at $50/year.

Dan, thanks for your comment! I’m glad to hear you were able to get started w/ YNAB so quickly. And THANK YOU for finding that error! You are right! Woops. Fixed it immediately 🙂

Great review! Just started using YNAB since yesterday and I’ve quickly grown accustomed to and love it.

On another note: under your ‘Con #1’ heading you stated “As of this writing (June 2017), YNAB doesn’t allow you to set your budget up on a computer.” I think you meant to say it doesn’t allow you to set your budget up on a mobile device. 😉